Customer Development

Test business ideas with the target audience and launch a successful product.

Get answers to your business questions in:

We are ready to cover all the tricky questions with CustDev

With this knowledge, you will tailor your products and services to meet customers' needs better and stay ahead of the competition.

How CustDev helps businesses

After conducting the research, you can stop assuming the client's needs and make snap judgments.

Sales conversion & LVT

Increasing sales conversion and LTV leads to more revenue and profits.

Analysis of why customers do not buy

Clear steps to motivate customers to return

Sales evaluation

Analytics of the offers efficiency

Product adaptation to the market

Product adaptation to better meet the needs and preferences of a specific target market or group of customers.

Analytics of project functionality through the clients' eyes

Features customers do not need in the product

What customers are willing to pay for

Marketing Performance check

Marketing Performance check & improvement allows aligning marketing efforts with the customers' needs leading to more effective communication and product development.

Customer purchase decision making

Efficient budget planning

What does our CustDev contain?

The CustDev methodology has vast advantages and is effective at creating a product from scratch and deploying it with an already working product. After all, only the client can say what he needs and what problems he wants to solve.

In-Depth Interviews

A pre-planned list of questions is used during a 1-1.5 hour conversation with the client to elicit the client's true meanings, motivations, and fears and understand how he currently solves the problem.

Interview analysis

Creating a portrait of a client based on more than 20 criteria, figuring out their motivations and behavior patterns, researching their user experience, and more.

Creating a Customer Journey Map

A customer journey map is a visual tool that shows the steps and experiences of a customer interacting with a business, used to increase customer satisfaction and optimize strategies.

Real-user testing of a product or service

Real-user testing can help identify issues or problems with a product or service and inform design and development decisions to improve the user experience.

Transform your business with our no-code solutions & CutDev expertise

Ready to take your business to the next level? After completing customer development with us, get a discount on your next project and build your business from the box with our no-code solutions.

What are the difficulties of a self-conducted CustDev?

During self-conducted customer development, businesses face various problems, including potential biases and blind spots in the research process and limited access to a diverse range of customers and their perspectives.

In most cases, the company needs an expert to properly analyze 20+ interview results and create meaningful analytics, conclusions, and recommendations. The task is usually assigned to inexperienced marketers, leading to ineffective CustDev with no new insights gained.

Drawing incorrect conclusions is the most significant hazard in research. Lack of experience makes it easy to fall into this trap. One common mistake is only to survey a biased sample, like current customers who are likely to praise the product. Neglecting those who chose a competitor or found an alternative solution leads to inaccurate results.

Our team visualizes the confirmed hypothesis and tests the idea of solving the client’s problem. A focus group tests the clickable prototype. We check the layouts, if any, against the client path and define the area that needs improvement.

Why choose us?

We define your target audience and draw up and test your product and market hypotheses.

We save your time

No need to allocate time for team management. A project manager will be assigned to oversee all project steps.

Providing solutions instead of posing inquiries

We assume responsibility for decision-making. When faced with a problem, we find a solution and inform you of its progress.

Comfortable payments

Payments are phased: begin with the initial cost, and you'll get the outcome of our effort for a more straightforward assessment and evaluation of our work.

CustDev + Development Combo

Elevate your product development game! Complete a customer development study with us and unlock a special discount for your next project. Take advantage of this exclusive offer!

CustDev FAQ

We’ve gathered the most confusing questions quickly answered. If, for some reason, your question is not here, feel free to contact us.

How many respondents do we need for research, and how can we find them?

To conduct customer development research, you must talk to people who fit your target customer profile. You only need a few respondents, but around 5-10 participants per customer segment can provide valuable insights. For example, you can find respondents through personal and professional networks, online platforms, or offering incentives. It’s essential to ensure that the participants represent your target market to get accurate and reliable research results.

Are there any ready-made questions for the interview?

When doing customer development interviews, the analyst puts together customized questionnaires or guidelines for each group of respondents. They’ll ask different questions depending on whether or not the person has used the product before.

Plus, the questions they ask will vary based on the specific product being researched and the study’s goals. For instance, some studies focus more on how users engage with the product, while others hone in on the difficulties users face and how they solve them.

How to compose questions for CustDev?

Basically, before conducting any customer development interviews, the analyst puts together a set of questions or an "interview guide." He/She customises these questions for each group of people being interviewed based on their history with the product. For example, if we're dealing with a B2B product, the questions we'd ask the end-users would differ from those we'd ask the purchasers.

It's crucial to focus on people's past experiences rather than their plans. That's because people can only speculate about what's to come, whereas their previous behaviour tells us a lot about how they're likely to act in the future. So the questions are carefully crafted to avoid steering the interviewee toward a particular response. For example, we wouldn't ask questions like "Do you like our product?" or "Do you think Problem X is important?" as they're likely to elicit positive answers, even if they're not entirely honest.

What are the stages of conducting customer development?

There are five key stages:

Defining your tasks and objectives: Setting clear goals for your research and determining what you want to achieve through your customer development efforts.

Identifying your research tools: You'll need to decide what tools to gather your data. For example, it could involve conducting interviews, focus groups, or other types of research.

Developing hypotheses: Based on your research goals, you'll need to develop ideas or theories about what you expect to find during your research.

Conducting your research: This is the fieldwork stage, where you'll research using your chosen tools and techniques.

Analyzing your data and reporting your findings: Finally, you'll need to analyze the collected data and use it to develop a report outlining your key findings and insights.

What will be the accuracy of the conclusions drawn from the research?

When conducting customer development, it's essential to ask the right questions. For instance, we don't ask the respondent about the future because the future is always uncertain, but we can understand behavioral patterns based on past experiences. Additionally, you should formulate questions that don't push the person toward a "correct" answer. Examples of poor questions include "How do you like our product?" and "Do you think problem X is important?" Almost everyone will respond positively to the first question and agree that problem X is important and needs to be solved.

Another common mistake in customer development is using a small sample size for interviews, such as 2 or 3. We recommend conducting 4-5 interviews per audience segment and at least 20 interviews for the entire study. This way, the data will be representative, and conclusions can be drawn for the business.

Why outsource Customer Development when it can be conducted in-house?

It's common for companies to outsource complex services like branding and website creation since these tasks require a specific set of skills that are only sometimes necessary in-house. Likewise, delegating research tasks yields a different result.

On the other hand, when companies attempt to conduct customer development interviews themselves, they often need help to overcome a roadblock. Despite running a few interviews, they need help to make sense of the information gathered. Unfortunately, this approach wastes time and resources, and even revisiting the task every few months doesn't help move the needle.

Frequently requested after CustDev

Website Audit

Company’s positioning

Brand's communication channels selection

Each campaign strategies development

Budget determination

Action plan creation

Marketing strategy development

Company’s positioning

Brand's communication channels selection

Each campaign strategies development

Budget determination

Action plan creation

Competitive intelligence

Key competitors identification

Data gathering & analysing

Data usage for your advantage

Competitors monitoring & reports creation

Regular review & update

Related Projects

Sustainable Agriculture

Smart farming in the Netherlands, which uptakes more CO2 than emits

Eco Sence

From Air Analysis to Carbon Credits: your Eco Companion

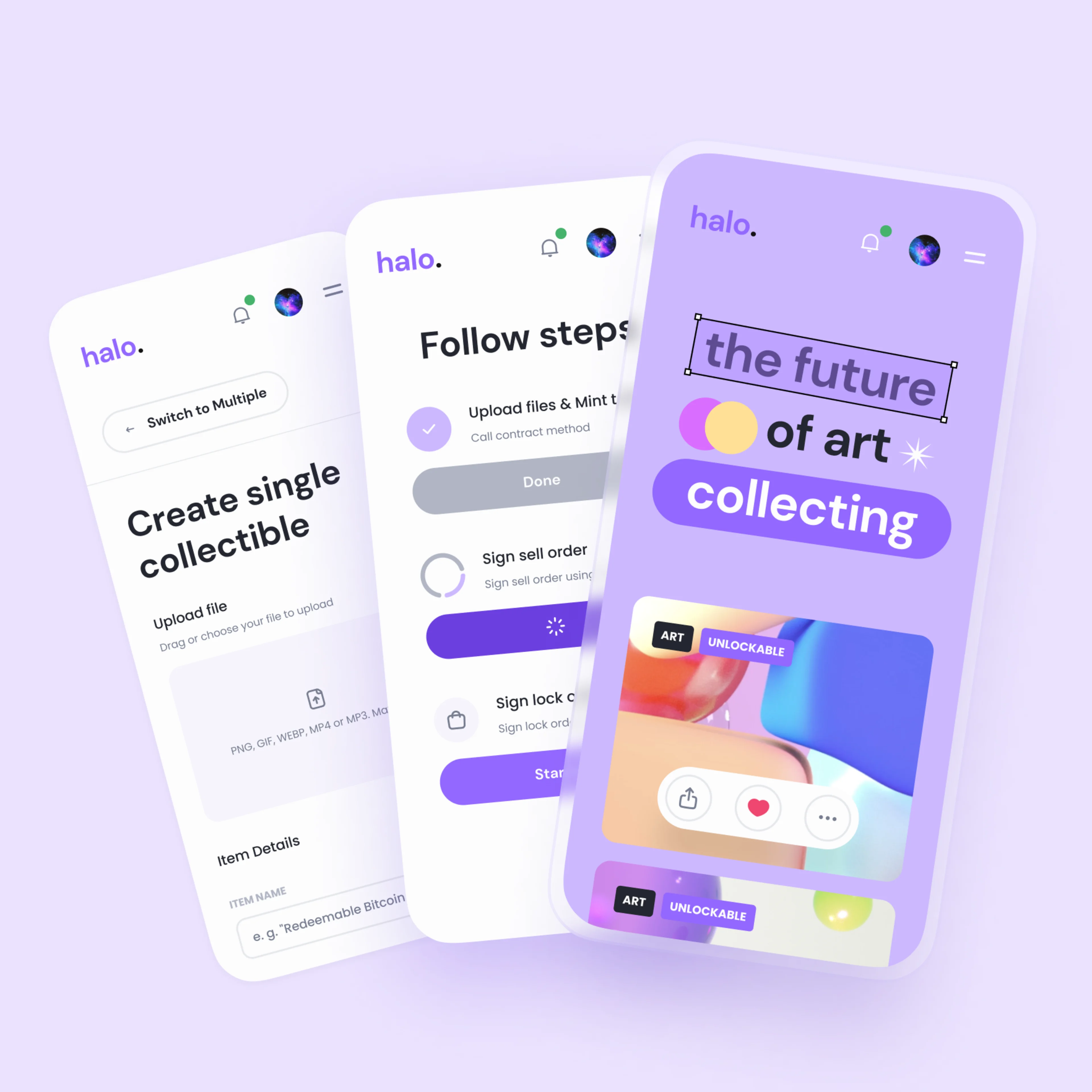

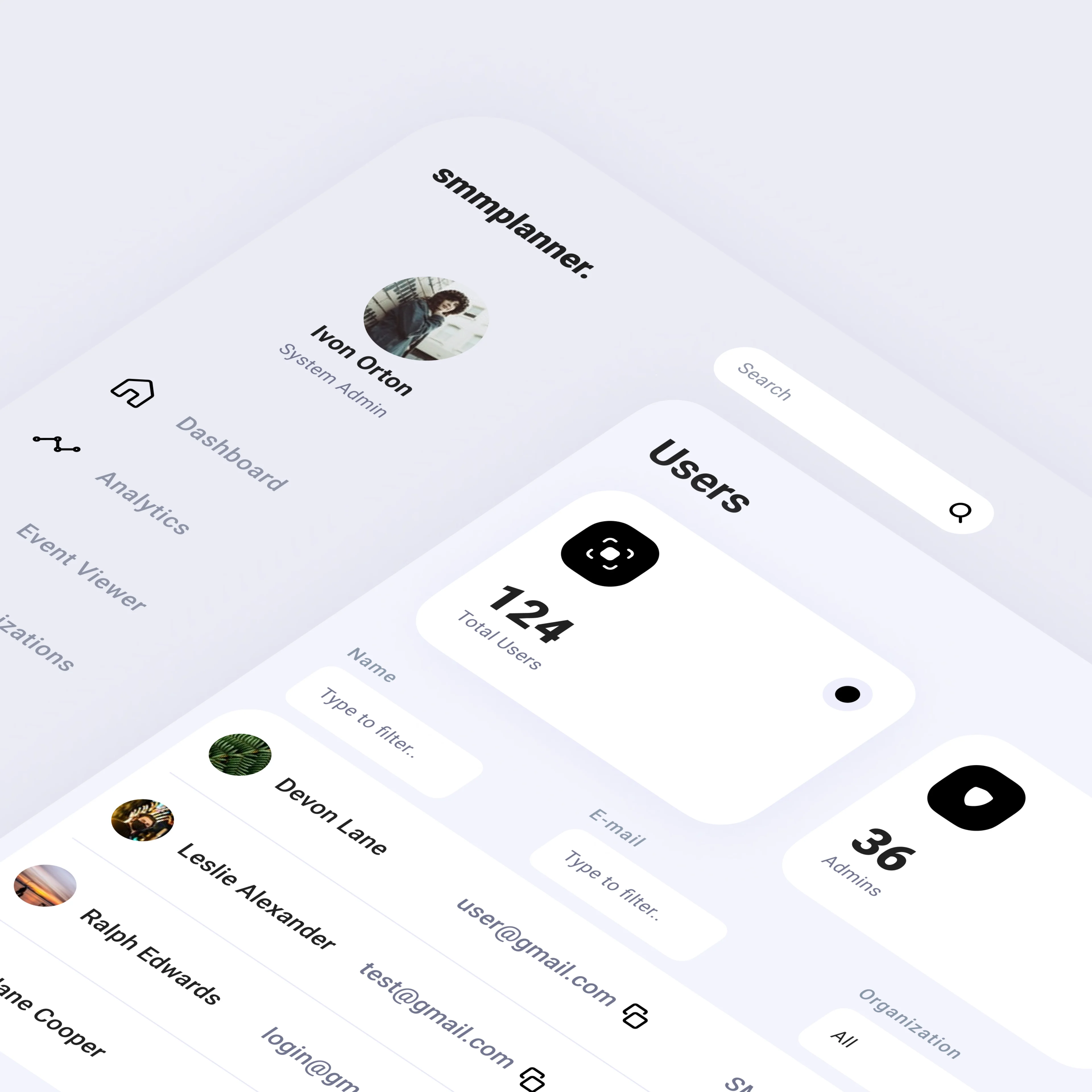

User Management Dashboard

Role-based social media management dashboard

Squads Development Community

Global full-stack development talent network